Midjourney Recap

Welcome to Vagabond Research

Table Of Contents

Welcome To Vagabond Research

What This Blog Is About

The Trading System

The End Result (Vision)

Roadmap Ahead

Welcome To Vagabond Research

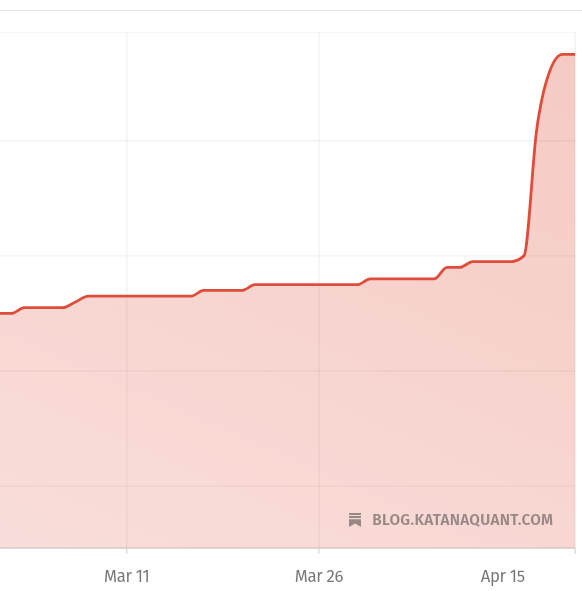

My last blogpost about slippage has brought in a lot of new subscribers. So, hi to all the new folks!

I didn't really anticipate such an uptick since the article was only meant as a quick and dirty update in between. Still a lot of people seemed to have liked its very short form content. The full scope of it might not have been readily apparent without further context. So let me clear up a few things:

What This Blog Is About

Let's start of with all the things it's not about, full Eminem vs. Pap Doc 8 Mile final battle style. My content is not about market making or high frequency trading. I don't have any experience in that area and wouldn't dare to write about it. The lines about what high frequency trading means are kind of blurry on social media. It comes in all sorts of variations and different wordings like scalping, daytrading, etc. are often used interchangeably. I'm mainly focusing on trading systems that use daily (EOD) price data as their driver.

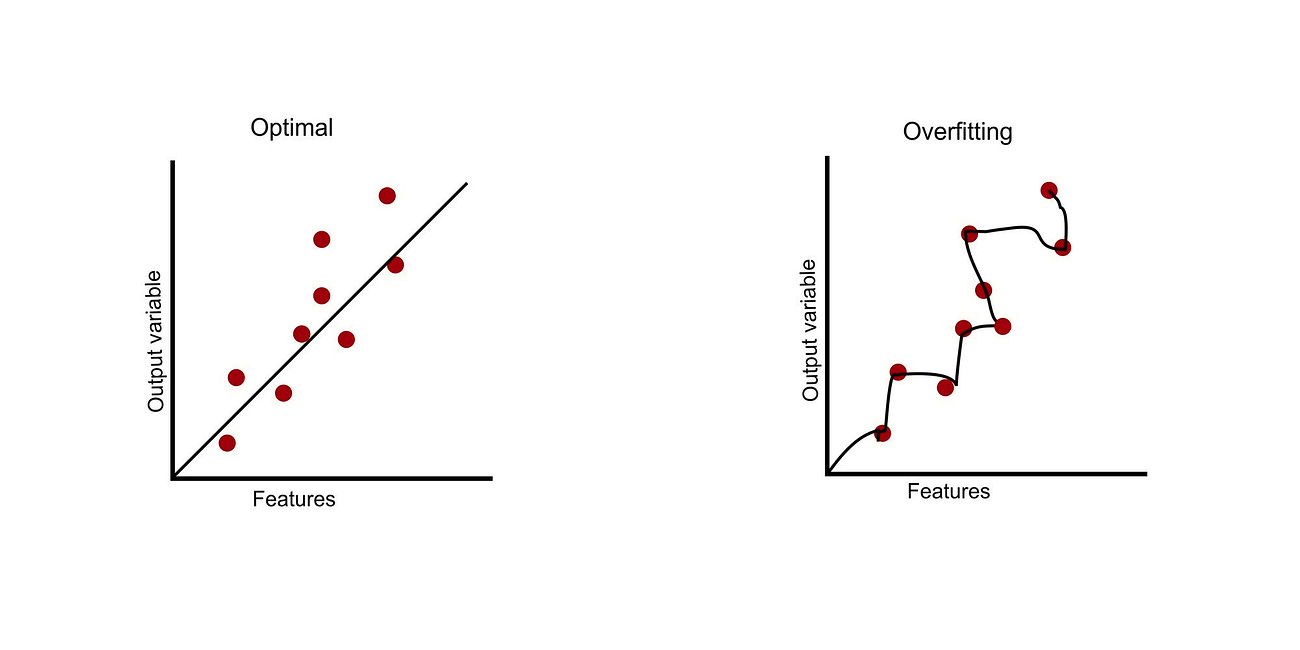

I'm not a finance professional! I come from a pure development background and a lot of this trickles through in my approach. The code that I'm sharing is often kept very simple and isn't optimized for anything yet. This often means that I'm taking shortcuts, prioritizing interfaces over implementations and precision to keep the development process going quickly (relatively.. this is "just" a side project of mine). In my opinion it's better to finish a somewhat reasonable baseline as a sort of proof of concept first before doing "everything right". This approach helps me to keep things simple in general and also prevents me from getting tangled up for hours in specifics that might not matter that much in the grand scheme of things. With most projects, we can always come back and change or improve things if needed.

In a more general sense, my blog is about systematic retail trading. I share what has worked for me, new things I'm exploring and what I'm currently working on.

Right now I'm building a systematic retail trading system in public. I'm sharing everything for free and try to keep it as free 2 play as possible. I also try to give some technical expertise on development techniques and best practices used where applicable. My goal is to make it so that anyone reading it can create such a system himself. For free. Since I'm also working in the security domain, I try to give some privacy and security related bits here and there when I think focusing on OpSec is absolutely necessary.

Due to all of the above, this system isn't ready to trade live yet! If you try to use this in the hopes of recreating its result, you're going to have a bad time! In fact, I don't really care all that much about its performance results at this point. I'm building it as a research center to work off of.

Rethinking Backtests

Recap We had a look at the basic structure any serious trading strategy should have and crafted a first draft for our own to get a better feel for the C.O.R.E. of our trading business.

This blog is basically the documentation of the iterations I'm going through while building this system and all the building blocks involved from scratch.

If you have questions or find any bugs, feel free to contact me at contact@katanquant.com or on my socials!

The Trading System

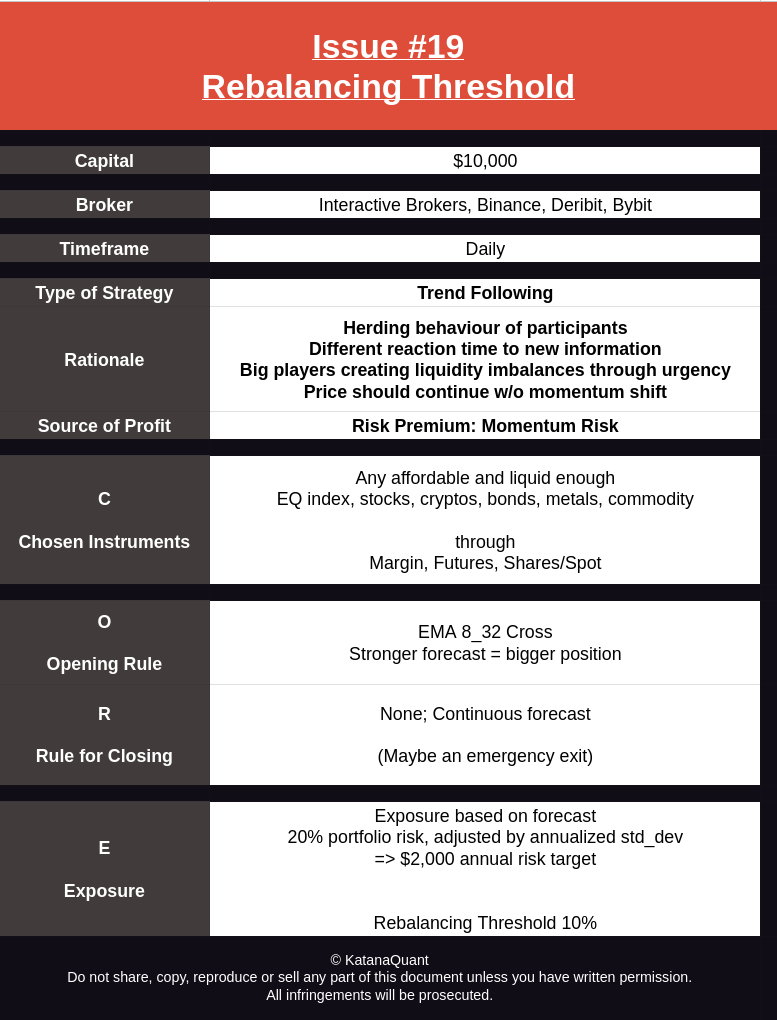

With all that out of the way, let's talk a little bit more about the system under development (SUD). It is a very simple high timeframe trend following model which uses EOD prices for signal creation. It is meant to be used on relatively liquid instruments, where my size is easily supported by the top level of the current orderbook. I'm rebuilding the system off of one I have running on equities and commodities already, extending it where I can with new knowledge I've gained.

Right now a continuous signal gets created using onle one rule, the EMA 8_32 crossover, with resulting positions scaled to the signals strength but capped to a maximum to filter out extreme outliers. You can read about the exact reasoning for this and the code to create it yourself in this article.

More info about the inner workings of the position sizing and risk targeting on a portfolio level can be found here.

The system pulls in its data for the forecasts from a very hacky and slow datahub I've built in this article.

A Dockerized Crypto Data Hub - Part I

Recap After talking about statistical models like Geometric Brownian Motion and Ornstein-Uhlenbeck to create realistic synthetic price series for backtesting, we're almost done with the data-part for our research lab.

The datahub is nothing special but can be used as a solid starting point with historical EOD prices for over 10k coins reaching back as far as 2011.

I've created the mnemonic C.O.R.E. recipe to help better internalize the absolute bare minimum anatomy of a trading strategy. It's still a work in progress system and I'll likely change a few of things during the development cycles. Here's the current state of my recipe:

The End Result (Vision)

The system is meant to become a Carver type trading system but I still have to work on some things to make it even considered to be worthy of that name. Carver puts a lot of emphasize on diversification, which I didn't include at all yet. There isn't even a single piece of code that handles portfolio optimization.

Right now, it mainly consists of the datahub and a super simple backtest, which I've improved over the last few weeks by incorporating perpetual crypto funding rates, adding rebalancing via error threshold and deducting a simple fixed amount of slippage for more accurate performance metrics. After all, all these things get overlooked routinely by retail traders.

To be able to tackle portfolio optimization across both, trading rules and instruments, I need to finish that backtester first so I can use its results in the optimizer. There are still some kinks I need to iron out first though.

Roadmap Ahead

Over the next few weeks I'll tackle things like proper cost calculations for funding rates, handling bid-ask spread and getting current EOD prices via exchange APIs on the fly while also adding a rigorous testing suite and version control on top to make the system in itself more robust and resilient towards future changes.

Only then, I will start to use it for proper strategy research and afterwards extend it with an adapter for real live trading execution.

Again, thanks for subscribing! I appreciate your support.

Stay tuned, Happy trading!

- Hōrōshi バガボンド

Disclaimer: The content and information provided by Vagabond Research, including all other materials, are for educational and informational purposes only and should not be considered financial advice or a recommendation to buy or sell any type of security or investment. Always conduct your own research and consult with a licensed financial professional before making investment decisions. Trading and investing can involve significant risk, and you should understand these risks before making any financial decisions.